UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

___________________________________

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | |

| ¨ | Preliminary Proxy Statement |

| |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ý | Definitive Proxy Statement |

| |

| ¨ | Definitive Additional Materials |

| |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

WORKIVA INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| ý | No fee required. |

| |

| ¨ | Fee paid previously with preliminary materials. |

| | |

| ¨ | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

| | |

| 1) | Title of each class of securities to which transaction applies: |

| | |

| 2) | Aggregate number of securities to which transaction applies: |

| | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| 4) | Proposed maximum aggregate value of transaction: |

| | |

| 5) | Total fee paid: |

| | |

¨ | Fee paid previously with preliminary materials. | |

| | |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| | |

| 1) | Amount Previously Paid: |

| | |

| 2) | Form, Schedule or Registration Statement No.: |

| | |

| 3) | Filing Party: |

| | |

| 4) | Date Filed: |

2900 University Blvd.

Ames, IA 50010

Telephone: (888) 275-3125

March 31, 2020April 17, 2023

Dear Fellow Stockholders:

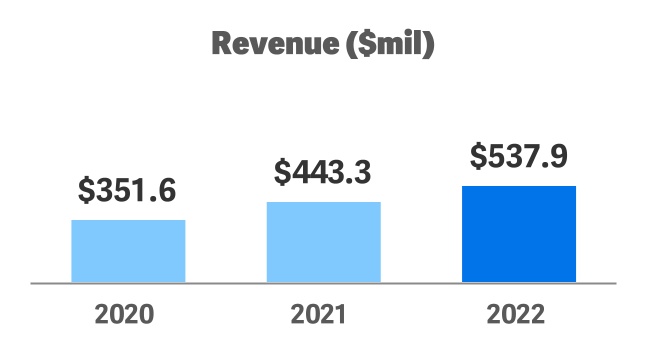

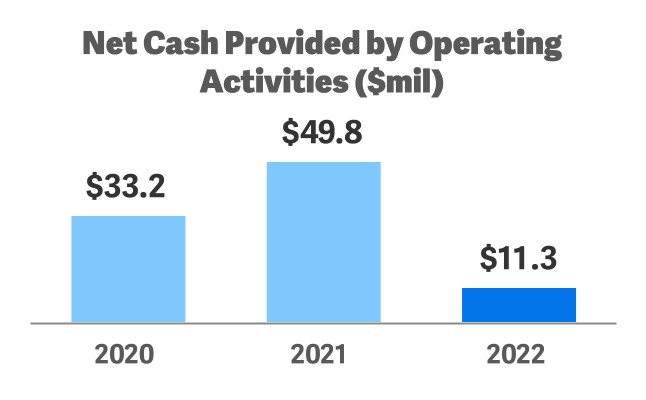

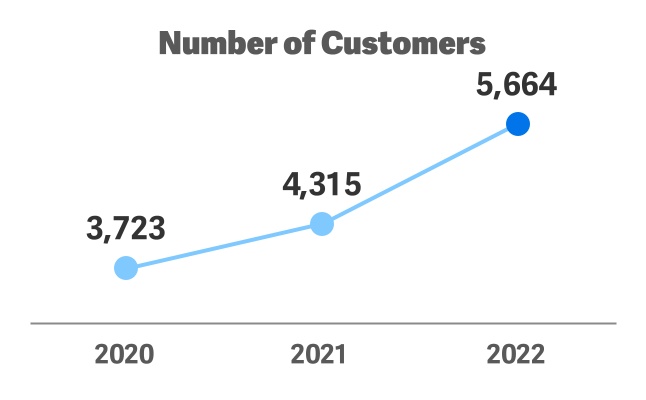

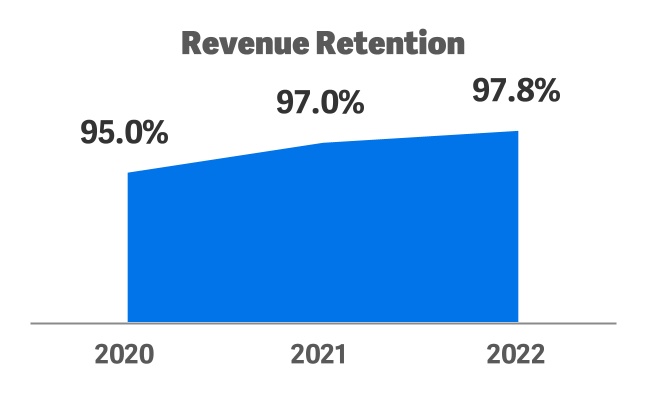

YouWorkiva delivered strong financial results in 2022 for our stockholders, beating full year guidance on revenue and operating margin. Our performance was a direct result of our global team of talented and dedicated employees who continue to execute on our strategy, take care of our customers and each other, and live by our Company values.

On April 1, 2023, I had the distinct privilege of succeeding Marty Vanderploeg as CEO of Workiva. Marty is now the Non-Executive Chair of the Board of Directors. In his new role, Marty, along with the entire Board, will continue to champion Workiva and support the executive leadership team as we move into our next phase of growth and impact.

While our roles have changed, our commitment to Workiva and its growth and success has not. We are cordially invitedaligned on Workiva’s core principles and values: a people-first culture, prioritizing our customers’ experience and success, continuous innovation, and a commitment to impact. These will continue to be cornerstones of our operations as we drive greater performance and productivity through the focused execution of our strategic initiatives.

Workiva is one of the most relevant and innovative technology companies of our time. We have a transformative platform and an enduring foundation on which to build our future. We remain bullish on our future opportunities as we continue to address the large global reporting market that we see before us.

Accordingly, on behalf of the Board of Directors and our leadership team, I’d like to invite you to attend our 2020the 2023 Workiva Inc. Annual Meeting of StockholdersStockholders. The meeting will be held virtually via live webcast on Tuesday, May 19, 202030, 2023, at 10:00 a.m. (Central Time), at the offices of Faegre Drinker Biddle & Reath LLP, 191 N. Wacker Drive, Suite 3700, Chicago, IL 60606..

All Workiva stockholders of record at the close of business on March 20, 2020April 3, 2023, are welcome to attend the Annual Meeting, but it is important that your shares are represented at the Annual Meeting whether or not you plan to attend. To ensure that you will be represented, we ask you to vote by telephone, by mail or over the Internet as soon as possible.

Along with the other members of your Board of Directors, I look forward to personally greeting those stockholders who attend this year's meeting. On behalf of the Board of Directors and our leadership team, I would like to express our appreciationThank you for your continued interesttrust in the businessand ongoing support of Workiva.

| | | | | | | | |

| | Sincerely, |

| | Martin J. VanderploegJulie Iskow

President & Chief Executive Officer and Director |

Workiva Inc.

2900 University Blvd.

Ames, IA 50010

Notice of Annual Meeting of Stockholders

Tuesday, May 19, 2020

10:00 a.m. Central Time

191 N. Wacker Drive

Suite 3700

Chicago, IL 60606

The principal business of the Annual Meeting will be to:

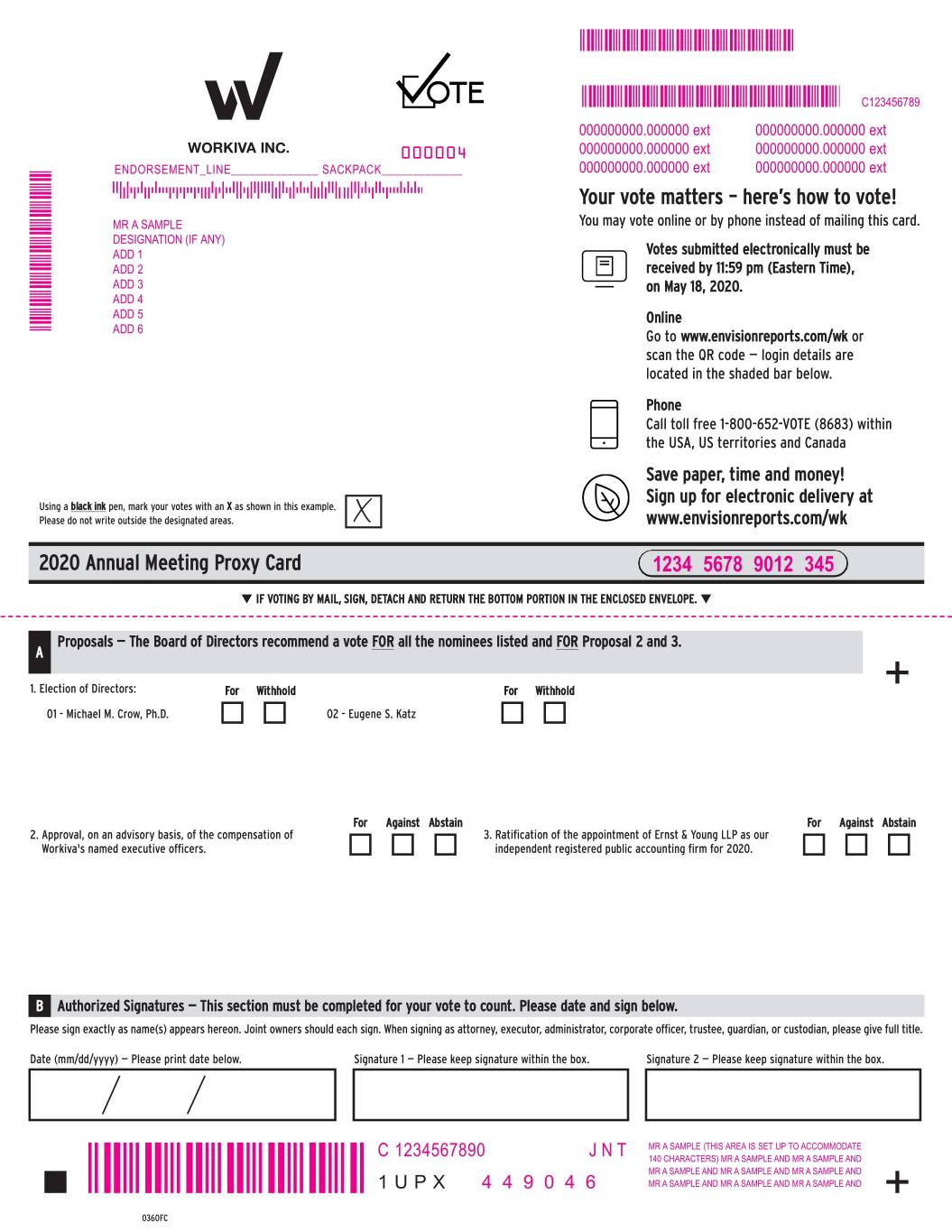

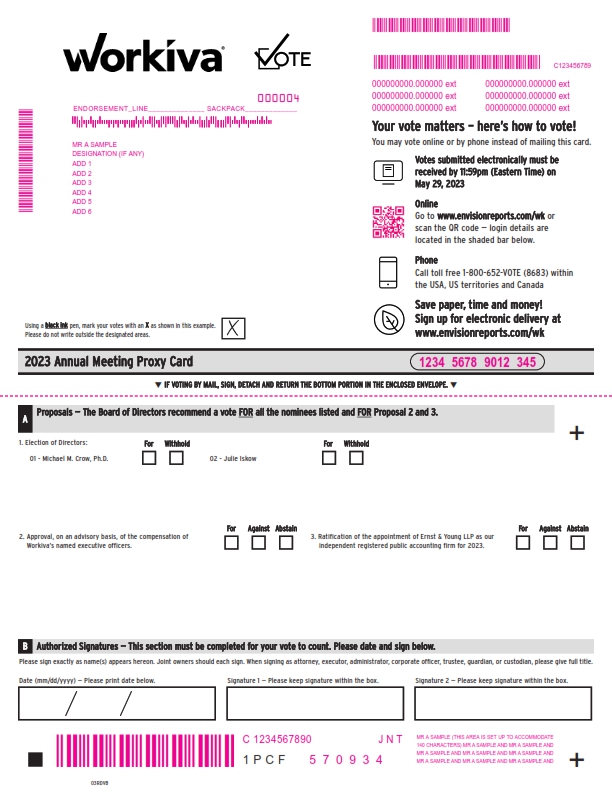

1.Elect two Class III directors for a three-year term;

2.Approve, on an advisory basis, the compensation of our named executive officers;

3.Ratify the appointment of Ernst & Young LLP ("EY") as our independent registered public accounting firm for the fiscal year ending December 31, 2020;2023; and

4.Transact any other business as may properly come before the meeting or any adjournment or postponement thereof.

You can vote at the Annual Meeting in persononline or by proxy if you were a stockholder of record at the close of business on March 20, 2020.April 3, 2023, by visiting www.meetnow.global/M5TJR6R and entering the 15-digit control number on the Proxy Card, Email or Notice of Availability of Proxy Materials you previously received. You may revoke your proxy at any time prior to its exercise at the Annual Meeting.

We are electronically disseminating Annual Meeting materials to our stockholders, as permitted under the "Notice and Access" rules approved by the Securities and Exchange Commission. Stockholders who have not opted out of Notice and Access will receive a Notice of Internet Availability of Proxy Materials containing instructions on how to access Annual Meeting materials via the Internet. The Notice also provides instructions on how to obtain paper copies if preferred.

| | | | | | | | |

| | By Order of the Board of Directors |

| | Troy M. Calkins |

| | Brandon E. Ziegler Executive Vice President, Chief Legal and Administrative Officer and Corporate Secretary |

Chicago, ILApril 17, 2023

March 31, 2020

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be held on May 19, 2020:30, 2023:

The Notice of Annual Meeting, Proxy Statement and our 20192022 Annual Report to Stockholders

are available electronically at www.envisionreports.com/wk

| | | | | | | | |

We intend to hold our annual meeting in person; however, we are continuing to monitor the public health and safety concerns related to coronavirus disease 2019 (COVID-19) and the related recommendations and protocols issued by public health authorities and federal, state, and local governments. The health and well-being of our various stakeholders is our top priority. Accordingly, if we determine that alternative Annual Meeting arrangements are advisable or required, we may decide to change the date, time or location of the meeting, including holding it solely by means of remote communication. If we do make such a change, then we will announce our decision as promptly as practicable and post additional information on our our website at http://www.workiva.com under the caption "Investor Relations." Please check the website in advance of the Annual Meeting date if you are planning to attend in person. | | |

| | |

Table of Contents

TABLE OF CONTENTS

QUESTIONS AND ANSWERS

Why am I receiving these materials?

The Board of Directors of Workiva Inc. ("Workiva" or the "Company") is making these proxy materials available to you on the Internet or, upon your request, by delivering printed versions of these materials to you by mail, in connection with the solicitation of proxies for use at our 20202023 Annual Meeting of Stockholders (the "Annual Meeting"), or at any adjournment or postponement of the Annual Meeting. The Annual Meeting will occurbe held virtually via a live webcast on Tuesday, May 19, 202030, 2023, at 10:00 a.m. (Central Time) at the offices of Faegre Drinker Biddle & Reath LLP, located at 191 North Wacker Drive, Suite 3700, Chicago, Illinois 60606.www.meetnow.global/M5TJR6R.

What is included in these materials?

These materials include this Proxy Statement for the Annual Meeting and our Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the year ended December 31, 2019.2022. We are first making these materials available to you on the Internet on or about March 31, 2020.April 17, 2023.

What is the purpose of the Annual Meeting?

For stockholders to vote on the following proposals:

1.To elect Michael M. Crow, Ph.D. and Eugene S. KatzJulie Iskow as Class III directors for three-year terms;

2.To approve, on an advisory basis, the compensation of our named executive officers, as described in this proxy statement;

3.To ratify the appointment of EY as our independent registered public accounting firm for the fiscal year ending December 31, 2020;2023; and

4.To transact any other business as may properly come before the Annual Meeting or at any adjournment or postponement thereof.

How does the Board of Directors recommend I vote on these proposals?

The Board recommends that you vote:

•"FOR" the election of Michael M. Crow, Ph.D. and Eugene S. KatzJulie Iskow as Class III directors;

•"FOR" the approval, on an advisory basis, of the compensation of our named executive officers, as described in this proxy statement; and

•"FOR" the ratification of the appointment of EY as our independent registered public accounting firm for the fiscal year ending December 31, 2020.2023.

WORKIVA INC.  2023 PROXY STATEMENT 1

2023 PROXY STATEMENT 1

Who is entitled to vote at the Annual Meeting?

Holders of our common stock as of the close of business on March 20, 2020,April 3, 2023, the record date, may vote at the Annual Meeting. As of the record date, there were 38,440,97449,386,777 shares of our Class A common stock and 8,595,5963,845,583 shares of our Class B common stock outstanding. Each share of Class A common stock is entitled to one vote, and each share of Class B common stock is entitled to ten votes. Holders of our Class A common stock and Class B common stock will vote as a single class on all matters described in this proxy statement.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered the stockholder of record with respect to those shares, and we sent the Notice of Internet Availability of Proxy Materials was sent directly to you by us.you. As a stockholder of record, you may vote your shares in person at the Annual Meeting or by proxy as described below.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the "beneficial owner" of shares held in street name. The Notice and, upon your request, the proxy materials, were forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your bank, broker or other nominee on how to vote your shares by following their instructions for voting.

How is the Annual Meeting being held?

Workiva Inc.'s 2023 Annual Meeting of Stockholders will be held virtually via live webcast on Tuesday, May 30, 2023, at 10:00 a.m., Central Time. Online access to the meeting will begin at 10:00 a.m., Central Time. Stockholders will not be able to attend the annual meeting in person.

How do I attend the Annual Meeting?

If you were a stockholder of record as of April 3, 2023 (i.e., you held your shares in your own name as reflected in the records of our transfer agent, Computershare), you can attend the meeting by accessing www.meetnow.global/M5TJR6R and entering the 15-digit control number on the Proxy Card, Email or Notice of Availability of Proxy Materials you previously received.

If you were a beneficial owner of record as of April 3, 2023 (i.e., you held your shares in an account at a brokerage firm, bank or other similar agent), you will need to obtain a legal proxy from your broker, bank or other agent. Once you have received a legal proxy from your broker, bank or other agent, it should be emailed to our transfer agent, Computershare, at legalproxy@computershare.com and should be labeled “Workiva Legal Proxy” in the subject line. Please include proof from your broker, bank or other agent of your legal proxy (e.g., a forwarded email from your broker, bank or other agent with your legal proxy attached or an image of your legal proxy attached to your email). Requests for registration must be received by Computershare no later than 5:00 p.m. Eastern Time on

WORKIVA INC.  2023 PROXY STATEMENT 2

2023 PROXY STATEMENT 2

Wednesday, May 24, 2023. You will then receive a confirmation of your registration, with a control number, by email from Computershare. At the time of the meeting, go to www.meetnow.global/M5TJR6R and enter your control number.

If you would like to enter the meeting as a guest in listen-only mode, click on the “Guest” tab after entering the meeting center at www.meetnow.global/M5TJR6R and enter the information requested on the following screen. Please note you will not have the ability to ask questions or vote during the meeting if you participate as a guest.

What if I encounter technical difficulties or trouble accessing the Annual Meeting?

Beginning 15 minutes prior to the start of and during the annual meeting, we will have a support team ready to assist stockholders with any technical difficulties they may have accessing or hearing the virtual meeting. If you encounter any difficulties accessing the Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting log-in page.

How can I submit questions at the Annual Meeting?

If you are attending the meeting as a stockholder of record or registered beneficial owner, questions can be submitted by accessing the meeting center at www.meetnow.global/M5TJR6R, entering your control number and clicking on the "Q&A" icon at the top of the page. To return to the main page, click the “Broadcast” icon at the top of the screen.

How can I vote my shares?

If you are a stockholder of record, you may vote:

•Via the Internet. You may vote by proxy via the Internet by following the instructions found on the proxy card.

•By Telephone. You may vote by proxy by calling the toll-free number found on the proxy card.

•By Mail. You may vote by proxy by filling out the proxy card and returning it in the envelope provided.

•In Person. You may vote in person at the Annual Meeting. You must request a ballot when you arrive. | | | | | |

| Via the Internet: You may vote by proxy via the Internet by following the instructions found on the Proxy Card, Email or Notice of Availability of Proxy Materials that you received. |

| By Telephone: You may vote by proxy by calling the toll-free number found on the Proxy Card. |

| By Mail: You may vote by proxy by filling out the Proxy Card and returning it in the envelope provided. |

| At the Meeting: You may vote your shares electronically during the annual meeting by clicking on the “Vote” icon on the Meeting Center site. |

Internet and telephone voting will be available 24 hours24-hours a day and will close at 11:59 p.m. Eastern Time on Monday, May 18, 2020.29, 2023.

If you are a beneficial owner of shares held in street name, you should have received from your bank, broker or other nominee instructions on how to vote or instruct the broker to vote your shares, which are generally contained in a "voting instruction form" sent by the broker, bank or other nominee. Please follow their instructions carefully. Beneficial owners generally may vote:

•Via the Internet. You may vote by proxy via the Internet by following the instructions on the voting instruction form provided to you by your broker, bank or other nominee.

•By Telephone. You may vote by proxy by calling the toll-free number found on the voting instruction form provided to you by your broker, bank or other nominee.

•By Mail. You may vote by proxy by filling out the voting instruction form and returning it in the envelope provided to you by your broker, bank or other nominee.

•In Person. If you wish to vote in person, you must obtain a legal proxy from the organization that holds your shares. Please contact that organization for instructions on how to obtain a legal proxy to you from your broker, bank or other nominee.

2 WORKIVA INC.  2023 PROXY STATEMENT 3

2023 PROXY STATEMENT 3

| | | | | |

| Via the Internet: You may vote by proxy via the Internet by following the instructions on the voting instruction form provided to you by your broker, bank or other nominee. |

| By Telephone: You may vote by proxy by calling the toll-free number found on the voting instruction form provided to you by your broker, bank or other nominee. |

| By Mail: You may vote by proxy by filling out the voting instruction form and returning it in the envelope provided to you by your broker, bank or other nominee. |

| At the Meeting: If you obtained a legal proxy and registered with Computershare to receive your 15-digit control number from Computershare, you may vote your shares electronically during the annual meeting by clicking on the “Vote” icon on the Meeting Center site. |

If you received more than one Notice of Internet Availability of Proxy Materials or proxy card, then you hold shares of Workiva common stock in more than one account. You should vote via the Internet, by telephone, by mail or in person for all shares held in each of your accounts.

If I submit a proxy, how will it be voted?

When proxies are properly signed, dated and returned, the shares represented by the proxies will be voted in accordance with the instructions of the stockholder. If no specific instructions are given, you give authority to Martin J. VanderploegJulie Iskow and Troy M. CalkinsBrandon E. Ziegler to vote the shares in accordance with the recommendations of our Board as described above. If any director nominee is not able to serve, proxies will be voted in favor of the other nominee and may be voted for a substitute nominee, unless our Board chooses to reduce the number of directors serving on our Board. If any matters not described in this Proxy Statement are properly presented at the Annual Meeting, then the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy.

Can I change my vote or revoke my proxy?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy before it is exercised by:

•Written notice to our Corporate Secretary; or

•Timely delivery of a valid, later-dated proxy or a later-dated vote by telephone or on the Internet; or

•Voting in person at the Annual Meeting.Internet.

If you are a beneficial owner of shares held in street name, you should follow the instructions of your bank, broker or other nominee to change or revoke your voting instructions. You may also vote in person at the Annual Meeting if you obtain a legal proxy as described above.

Can I attend the Annual Meeting?

You are invited to attend the Annual Meeting if you are a registered stockholder or a beneficial owner as of the record date or if you hold a valid proxy for the Annual Meeting. In order to enter the Annual Meeting, you must be prepared to present photo identification acceptable to us, such as a valid driver's license or passport. If you are a beneficial owner, you will need to provide proof of beneficial ownership on the record date, such as a recent account statement showing your ownership, a copy of the voting instruction card provided by your broker, trustee or nominee, or other similar evidence of ownership.

3 WORKIVA INC.  2023 PROXY STATEMENT 4

2023 PROXY STATEMENT 4

We intend to hold our annual meeting in person; however, we are continuing to monitor the public health and safety concerns related to coronavirus disease 2019 (COVID-19) and the related recommendations and protocols issued by public health authorities and federal, state, and local governments. The health and well-being of our various stakeholders is our top priority. Accordingly, if we determine that alternative Annual Meeting arrangements are advisable or required, we may decide to change the date, time or location of the meeting, including holding it solely by means of remote communication. If we do make such a change, then we will announce our decision as promptly as practicable and post additional information on our our website at http://www.workiva.com under the caption "Investor Relations." Please check the website in advance of the Annual Meeting date if you are planning to attend in person.

What constitutes a quorum at the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority in voting power of the shares of our common stock issued and outstanding and entitled to vote at the Annual Meeting must be present or represented to conduct business at the Annual Meeting. You will be considered part of the quorum if you return a signed and dated proxy card, if you vote by telephone or Internet, or if you attend the Annual Meeting.

Abstentions and withhold votes are counted as "shares present" at the Annual Meeting for purposes of determining whether a quorum exists. Proxies submitted by banks, brokers or other holders of record holding shares for you as a beneficial owner that do not indicate a vote for some of or all the proposals because that holder does not have voting authority and has not received voting instructions from you (so-called "broker non-votes") are also considered "shares present" for purposes of determining whether a quorum exists. If you are a beneficial owner, these holders are permitted to vote your shares on the ratification of the appointment of our independent registered public accounting firm, even if they do not receive voting instructions from you.

What is the voting requirement to approve each of the proposals?

Provided that there is a quorum, the voting requirements are as follows:

| | | | | | | | | | | |

Proposal | | Vote | | | | | | | | | | | | | | | |

| Proposal | | Voting Options | | Votes Required to Adopt Proposal | | Effect of Abstentions and Withhold Votes | | Broker Discretionary Voting Allowed? |

| | | | | | | | | |

| Election of directors | | For or withhold on each nominee | | Plurality of votes cast | | No effect | | No |

| Advisory approval * of the compensation of our named executive officers | | For, against, or abstain | | Majority of votes cast | | No effect | | No |

| Ratification of appointment of independent registered public accounting firm | | For, against, or abstain | | Majority of votes cast | | No effect | | Yes |

* The say on pay vote is advisory only, but our Board of Directors will consider carefully the results of the vote.

4 WORKIVA INC.  2023 PROXY STATEMENT 5

2023 PROXY STATEMENT 5

Where can I find a

bleofContents list of stockholders entitled to vote at the Annual Meeting? A list of stockholders of record will be available during the annual meeting for inspection by stockholders of record for any legally valid purpose related to the annual meeting at www.meetnow.global/M5TJR6R.

What is the impact of abstentions, withhold votes and broker non-votes?

Abstentions, withhold votes and broker non-votes are considered "shares present" for the purpose of determining whether a quorum exists, but will not be considered votes properly cast at the Annual Meeting and will have no effect on the outcome of the vote. Under the rules of the New York Stock Exchange or NYSE,("NYSE"), without voting instructions from beneficial owners, brokers will have discretion to vote on the ratification of the appointment of the independent registered public accounting firm but not on the other proposals. Therefore, in order for your voice to be heard, it is important that you vote.

Who pays for the cost of this proxy solicitation?

WeWorkiva will pay all the costs of preparing, mailing and soliciting the proxies. We will ask brokers, banks, voting trustees and other nominees and fiduciaries to forward the proxy materials to the beneficial owners of our common stock and to obtain the authority to execute proxies. We will reimburse them for their reasonable expenses upon request. In addition to mailing proxy materials, our directors, officers and employees may solicit proxies in person, by telephone or otherwise. These individuals will not be specially compensated.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We also will disclose voting results on a Current Report on Form 8-K that we will file with the Securities and Exchange Commission or SEC,("SEC"), within four business days after the Annual Meeting.

Why did I receive a Notice of Internet Availability of Proxy Materials rather than a full set of proxy materials?

In accordance with the SEC rules, we have elected to furnish our proxy materials, including this Proxy Statement and the Annual Report, primarily via the Internet rather than by mailing the materials to stockholders. The Notice of Internet Availability of Proxy Materials provides instructions on how to access our proxy materials on the Internet, how to vote, and how to request printed copies of the proxy materials. Stockholders may request to receive future proxy materials in printed form by following the instructions contained in the Notice of Internet Availability of Proxy Materials. We encourage stockholders to take advantage of the proxy materials on the Internet to reduce the costs and environmental impact of our Annual Meeting.

WORKIVA INC.  2023 PROXY STATEMENT 6

2023 PROXY STATEMENT 6

How can I obtain Workiva's Form 10-K and other financial information?

Stockholders can access our 20192022 Annual Report, which includes our Form 10-K, and other financial information, on the SEC's website and on our website at http:https://www.workiva.com under the caption "Investor Relations."Investors." Alternatively, stockholders can request a paper copy of the Annual Report by writing to: Workiva Inc., 2900 University Boulevard, Ames, Iowa 50010, Attention: Corporate Secretary.

How do I submit a stockholder proposal for consideration at next year's annual meeting of stockholders?

For a proposal to be included in our proxy statement for the 20212024 annual meeting of stockholders, you must submit it no later than December 1, 2020.19, 2023. Your proposal must be in writing and comply with the proxy rules of the SEC. You should send your proposal to: Workiva Inc., 2900 University Boulevard, Ames, Iowa 50010, Attention: Corporate Secretary.

You also may submit a proposal that you do not want included in the proxy statement but that you want to raise at the 20212024 annual meeting of stockholders. We must receive this type of proposal in writing on or after January 19, 2021,31, 2024, but no later than February 18, 2021.March 1, 2024.

As detailed in our Bylaws, to bring a proposal other than the nomination of a director before an annual meeting of stockholders, your notice of proposal must include: (i) a brief description of the business desired to be brought before the annual meeting, the text of the proposal or business (including the text of any resolutions proposed for consideration and in the event that such business includes a proposal to amend our Bylaws, the language of the proposed amendment), and the reasons for conducting such business at the annual meeting and any material interest in such business of such stockholder and beneficial owner, if any, in such business; (ii) any other information relating to you or any other beneficial owner, if any, on whose behalf the proposal is being made, (ii) any other information relating to such stockholder and any such beneficial owner required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for the proposal and pursuant to and in accordance with Section 14(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and the rules and regulations promulgated thereunder; and (iii) the information described in clause (vi) in the question immediately below (with any references below to a "nomination" being deemed to refer to such business desired to be brought before the annual meeting).

How do I recommend a director nominee?

If you wish to nominate an individual for election as director at the 20212024 annual meeting of stockholders, we must receive your written nomination on or after January 19, 2021,31, 2024, but no later than February 18, 2021.March 1, 2024. You should send your proposal to: Workiva Inc., 2900 University Boulevard, Ames, Iowa 50010, Attention: Corporate Secretary.

As detailed in our Bylaws, for a nomination to be properly brought before an annual meeting, your notice of nomination must include: (i) the name, age, business address and residence address of each nominee proposed in such notice; (ii) the principal occupation or employment of each such nominee; (iii) the number of shares of Workiva capital stock

WORKIVA INC.  2023 PROXY STATEMENT 7

2023 PROXY STATEMENT 7

that are owned of record and beneficially by each such nominee (if any); (iv) such other information concerning each such nominee as would be required to be disclosed in a proxy statement soliciting proxies for the election of such nominee as a director in an election contest (even if an election contest is not involved) or that is otherwise required to be disclosed under Section 14(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and the rules and regulations promulgated thereunder; (v) the consent of the nominee to being named in theany proxy statementmaterials as a nominee and to serving as a director if elected; and (vi) as to you and the beneficial owner, if any, on whose behalf the nomination is made: (A) your name and address as they appear on our books and of any such beneficial owner, if any, on whose behalf the nomination is being made;owner; (B) the class and number of our shares that are owned by you (beneficially and of record) or by you and by theany such beneficial owner if any, on whose behalf the nomination is being made, as of the date of your notice, and a representation that you will notify us, in writing of the class and number of such shares owned of record and beneficially as of the record date for the meeting promptly following the later of the record date for the meeting or the date notice of the record date for the meeting is first publicly disclosed;disclosed, in writing of the class and number of such shares owned by you (beneficially and of record) or by any such beneficial owner as of the record date for the meeting; (C) a description of any agreement, arrangement or understanding with respect to such nomination between or among you, any such beneficial owner and any of youryou or their respective affiliates or associates, and any others (including their names) acting in concert with any of the foregoing, and a representation that you will notify us, in writing of any such agreement, arrangement or understanding in effect as of the record date for the meeting promptly following the later of the record date or the date notice of the record date is first publicly disclosed;disclosed, in writing of any such agreement, arrangement or understanding in effect as of the record date for the meeting; (D) a description of any agreement, arrangement or understanding (including any

derivative or short positions, profit interests, options, hedging transactions, and borrowed or loaned shares) that has been entered into as of the date of your notice by, or on behalf of, you, any such beneficial owner, or any of your or their respective affiliates or associates, the effect or intent of which is to mitigate loss to, manage risk or benefit of share price changes for, or increase or decrease the voting power of you, any such beneficial owner, or any of your or their respective affiliates or associates with respect to shares of our stock, and a representation that you will notify us, in writing of any such agreement, arrangement or understanding in effect as of the record date for the meeting promptly following the later of the record date or the date notice of the record date is first publicly disclosed;disclosed, in writing of any such agreement, arrangement or understanding in effect as of the record date for the meeting; (E) a representation that you are a holder of record of our shares entitled to vote at the meeting and intend to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; (F) a representation whether you or theany such beneficial owner if any, intends or is part of a group that intends to deliver a proxy statement and/or form of proxy to holders of at least the percentage of our outstanding capital stock required to approve the nomination and/or otherwise to solicit proxies from stockholders in support of the nomination; and (G) any other information relating to you or theany such beneficial owner if any, required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for the election of directors in an election contest (even if an election contest is not involved) or that is otherwise required to be disclosed under Section 14(a) of the Exchange Act and the rules and regulations promulgated thereunder. We may require any proposed nominee to furnish such other information as we may reasonably require to determine the eligibility of such proposed nominee to serve as an independent director or that could be material to a reasonable stockholder's understanding of the independence, or lack thereof, of such nominee.

7 WORKIVA INC.  2023 PROXY STATEMENT 8

2023 PROXY STATEMENT 8

In addition to satisfying the foregoing requirements under our Bylaws, including the timelines, to comply with the universal proxy rules, if you intend to solicit proxies in support of director nominees other than our nominees for the 2024 annual meeting, you must include in your notice the information required by Rule 14a-19 of the Exchange Act.

WORKIVA INC.  2023 PROXY STATEMENT 9

2023 PROXY STATEMENT 9

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Certificate of Incorporation provides that our Board must consist of two or more directors, and the number of directors to hold office at any time may be determined from time to time by resolution of our Board. Our Board currently consists of seven members. Our Board is divided into three classes, designated as Class I, Class II and Class III. Upon the expiration of the initial term of office for each class of directors, each director in that class will be elected for a three-year term and serve until a successor is duly elected and qualified or until his or her earlier death, resignation or removal.

The table below sets forth information with respect to our directors as of March 20, 2020:April 3, 2023:

| | | | | | | | |

Name | Age | Director Since |

| | | Name |

|

Class III Directors -

Term Expiring at the 20202023 Annual Meeting | | |

| Michael M. Crow, Ph.D. | 64 | | December 2014 | |

Eugene S. Katz | 74 | | December 2014 | Julie Iskow |

|

Class I Directors -

Term Expiring at the 20212024 Annual Meeting | | |

| Robert H. Herz | 66 | | December 2014 | |

| | David S. Mulcahy | 67 | | December 2014 | |

|

Class II Directors -

Term Expiring at the 20222025 Annual Meeting | | Brigid A. Bonner |

| | Suku Radia |

| | Martin J. Vanderploeg, Ph.D. | 63 | | December 2014 | |

Brigid A. Bonner | 59 | | October 2018 | |

Suku Radia | 68 | | December 2014 | |

There are two Class III directors whose term expiresterms expire at the 20202023 Annual Meeting. Upon the recommendation of our Nominating and Governance Committee, our Board has nominated Dr. Crow and Mr. KatzMs. Iskow for re-election as Class III directors. Biographical information for each director and director nominee is contained in the following section. If elected at the Annual Meeting, each of these nominees will serve for a three-year term expiring at the 20232026 annual meeting of stockholders and until his or her successor has been duly elected and qualified or until his or her earlier death, resignation or removal. Each person nominated for election has agreed to serve if elected, and we have no reason to believe that any nominee will be unable to serve. If any nominee is not able to serve, proxies will be voted in favor of the other nominee and may be voted for a substitute nominee, unless our Board chooses to reduce the number of directors serving on our Board. Unless otherwise instructed, the proxy holders will vote the proxies received by them "FOR" the election of Dr. Crow and Mr. KatzMs. Iskow as Class III directors.

8 WORKIVA INC.  2023 PROXY STATEMENT 10

2023 PROXY STATEMENT 10

Board Qualifications

Our Board has delegated to our Nominating and Governance Committee the responsibility for recommending to our Board the nominees for election as directors at the annual meeting of stockholders and for recommending persons to fill any vacancy on our Board. Our Nominating and Governance Committee selects individuals for nomination to our Board based on the following criteria. Nominees for director must:

•Possess fundamental qualities of intelligence, honesty, perceptiveness, good judgment, maturity, high ethics and standards, integrity, fairness and responsibility.

•Have a genuine interest in Workiva and recognition that as a member of our Board, each director is accountable to all of our stockholders, not to any particular interest group.

•Have a background that demonstrates an understanding of areas of importance to Workiva's business: technology/SaaS, risk and financial management, leadership, ESG, corporate governance, sales and marketing, human capital management, international operations, and cybersecurity.

•Have no conflict of interest or legal impediment that would interfere with the duty of loyalty owed to Workiva and our stockholders.

•Have the ability and be willing to spend the time required to function effectively as a director.

•Be compatible and able to work well with other directors and executives in a team effort with a view to a long-term relationship with Workiva as a director.

•Have independent opinions and be willing to state them in a constructive manner.

Directors are selected on the basis of talent and experience. Although there is no specific policy regarding Board diversity quotas, diversity of background, including diversity of gender, race, ethnic or geographic origin and age, and experience in business, government and education and in engineering, computer software, technology and other areas relevant to our activities, are factors in the selection process. We also consider management and leadership experience with respect to environmental, social, and governance issues that are material to Workiva, as well as experience with cybersecurity and information security risk management. As a majority of our Board must consist of individuals who are independent, a nominee's ability to meet the independence criteria established by the NYSE is also a factor in the nominee selection process.

For a better understanding of the qualifications of each of our directors, we encourage you to read their biographies set forth in this proxy statement.

WORKIVA INC.  2023 PROXY STATEMENT 11

2023 PROXY STATEMENT 11

The following categories identify the various skills that our directors possess:

| | | | | |

| |

| Cybersecurity Workiva handles the financial and non-financial data of thousands of companies worldwide |

| |

| |

| ESG Workiva has a generational opportunity in ESG reporting, with a world-class product |

| |

| |

| Risk and Financial Management Workiva benefits from directors who have experience and expertise in both risk and financial management, including audit and controls |

| |

| |

| Governance Workiva benefits from directors who can bring best practice governance experience to the board |

| |

| |

| Human Capital Management Culture and talent are core to Workiva’s success |

| |

| |

| International Growth outside of North America presents an attractive opportunity for Workiva |

| |

| |

| Sales and Marketing Sales and marketing strategy and execution is key to Workiva’s growth and profitability |

| |

| |

| Senior Leadership As a business continuing to scale, Workiva benefits from directors with first hand senior leadership experience |

| |

| |

| Technology/SaaS Workiva benefits from directors who have expertise in SaaS technology & product strategy, product development, and AI & data analytics |

WORKIVA INC.  2023 PROXY STATEMENT 12

2023 PROXY STATEMENT 12

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Brigid A.

Bonner | | | Michael M. Crow, Ph.D. | | | Robert H.

Herz | | | Julie

Iskow | | | David S. Mulcahy | | | Suku

Radia | | | Martin J. Vanderploeg |

| | President,

Bonner Consulting | | | President, Arizona State University | | | President, Robert H. Herz LLC | | | President and Chief Executive Officer, Workiva Inc. | | | President, MABSCO Capital, Inc. | | | Retired Chief Executive Officer, Bankers Trust Company | | | Former Chief Executive Officer, Workiva Inc. |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Cybersecurity | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| ESG | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Risk and Financial Mgmt | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Governance | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Human Capital Mgmt | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| International | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Sales and Marketing | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Senior Leadership | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Technology/SaaS | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | 5/9 | | | 7/9 | | | 5/9 | | | 9/9 | | | 5/9 | | | 4/9 | | | 9/9 |

WORKIVA INC.  2023 PROXY STATEMENT 13

2023 PROXY STATEMENT 13

The following is a brief biographical summary of the experience of our directors and director nominees:

Brigid. A. Bonner. Ms. Bonner has served since March 2015 as the Chief Experience Officer of CaringBridge, a global nonprofit social network dedicated to helping family and friends communicate with and support loved ones during a health journey. From June 2009 to December 2013, Ms. Bonner served as Vice President of Digital Marketing for The Schwan Food Company, a privately held business that manufactures and markets quality foods through home-delivery, retail-grocery and food-service channels. In addition, Ms. Bonner has been the principal of Bonner Consulting, a strategy consulting business, since 2007. Ms. Bonner's prior experiences include serving as Senior Vice President Specialized Care of UnitedHealth Group, as Chief Marketing Officer and Chief Information Officer of SimonDelivers.com, and as a Vice President and General Manager of Target Corporation. Ms. Bonner holds a B.S. in Journalism and Industrial Administration from Iowa State University and an M.B.A. from Harvard Graduate School of Business Administration.

Ms. Bonner contributes valuable perspective to our Board based on her background in retail, technology and healthcare industries, her leadership roles in technology, marketing, sales and operations for start-up as well as large corporations, and her service on the Boards of public and private companies. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Skills | | |

| | |

| | | | | |

| Background Brigid A. Bonner is President of Bonner Consulting, which specializes in strategy, leadership development,digital transformation, and consumer experience engineering. She has held marketing, operations, and technology leadership roles across multiple sectors. From 2015 to 2021, Ms. Bonner was Chief Experience Officer of global nonprofit social network CaringBridge, where she oversaw product development, marketing, product design, and customer experience. Prior to CaringBridge, she held executive roles at Schwan’s Home Service; UnitedHealth Group, where she served as Chief Information Officer for UnitedHealth Technologies; SimonDelivers; Target; and IBM. | | Select experience •Deep experience in turning strategy into practical operating plans, built through leadership roles at multiple organizations •Specialist in digital transformation and combining creative marketing with technology to drive growth •Has held numerous leadership roles in areas of information security, technology, sales and operations for both start-ups and large corporations Education and awards MBA – Harvard Business School; Bachelor’s in Journalism and Industrial Administration – Iowa State University Other board experience •Medica (2018 to present) •Director and Chair of the Nom/Gov Committee, Analysts International Corporation (NASDAQ: ANLY) (2005 to 2013) |

| Brigid A. Bonner Age: 62 | | | |

| Board member since 2018 Board Committees: •Compensation, chair •Nom/Gov, member | | | |

Michael M. Crow, Ph.D. Dr. Crow is the President of Arizona State University ("ASU"), a position he has held since 2002, and is also currently a Professor of Science and Technology Policy at ASU. Prior to ASU and beginning in 1992, Dr. Crow served in a variety of leadership positions and as a professor at Columbia University, New York. From 2003 to 2008, he served as a director of Aquila, Inc. Dr. Crow has served as a consultant for the Moscow School of Management since 2013 and served as a consultant for the Malaysian Global Science and Innovation Advisory Council from 2011 to 2014. From 2008 to 2014, he served as a member of our advisory board. In addition, Dr. Crow served as a director of Engineering Animation, Inc. from 1991 to 2000. Dr. Crow earned a B.A. in Political Science and Environmental Studies from Iowa State University and earned his Ph.D. in Public Administration (Science and Technology Policy) from Syracuse University. Dr. Crow has been an adviser to the U.S. Departments of State, Commerce and Energy, as well as various defense and intelligence agencies on matters of science and technology policy related to intelligence and national security. A fellow of the National Academy of Public Administration, and member of the National Advisory Council on Innovation and Entrepreneurship and Council on Foreign Relations, he is the author of books and articles relating to the design and analysis of knowledge enterprises, technology transfer, sustainable development, and science and technology policy.

Dr. Crow brings significant experience in and understanding of technology development, strategy, and organizational decision-making to our Board. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | Skills | | |

| | |

| | | | | |

| Background Michael M. Crow, Ph.D., is President and a Professor of Science and Technology at Arizona State University, a post he has held since 2002. Under his tenure, ASU has grown from a regional university to a world-renowned public research institution with tremendous societal impact, an accomplishment reflected by its unchallenged designation as the most innovative university every year since the inception of the category in U.S. News & World Report. From 1992 to 2002, he served in leadership roles at Columbia University, including Executive Vice Provost and Director of the Earth Institute. Dr. Crow has advised the U.S. Departments of State, Commerce, Energy, and various defense and intelligence agencies on the connection between science and technology policy and intelligence and national security. He is a fellow of the National Academy of Public Administration, a member of the National Advisory Council on Innovation and Entrepreneurship, and a member of the Council on Foreign Relations. He has authored numerous books and articles on science and technology policy, knowledge enterprises, and sustainable development. | | Select experience •Business leadership expertise built through decades managing large organizations, including Arizona State University, America’s largest university •Published technology, innovation, and sustainable development expert Education and awards Ph.D in Public Administration (Science and Technology Policy) – Syracuse University; BA in Political Science and Environmental Studies – Iowa State University, 2021 Elected Member, American Academy of Arts & Sciences, 2021 GlobalMindED Inclusive Leader Award, 2020 National Council on Science and the Environment Lifetime Achievement Award Other board experience •Aquila (NYSE: ILA) (2003 to 2008) •Director and Chair of the Board, InQTEL (1999 to present) |

| Michael M. Crow, Ph.D. Age: 67 | | | |

| Board member since 2014 Board Committee: •Nom/Gov, chair | | | |

9 WORKIVA INC.  2023 PROXY STATEMENT 14

2023 PROXY STATEMENT 14

Robert H. Herz. Mr. Herz is a member of the board of directors of the Sustainability Accounting Standards Board Foundation. From 2011 to 2014, he served as a member of our advisory board. Since 2010, Mr. Herz has served as President of Robert H. Herz LLC, which provided consulting services to us prior to our initial public offering. Mr. Herz spent the majority of his career until 2002 as an audit partner at PricewaterhouseCoopers and its predecessor companies. From 2002 to 2010, Mr. Herz was the Chairman of the Financial Accounting Standards Board ("FASB"). He has served as a member of the board of directors of the Federal National Mortgage Association ("Fannie Mae") since 2011 and of Morgan Stanley (NYSE: MS) since 2012. Mr. Herz is also an executive-in-residence at the Columbia University Business School. He holds a B.A. in Economics from the University of Manchester, England and is also a certified public accountant and a U.K. Chartered Accountant. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Skills | | |

| | |

| | | | | |

| Background Robert H. Herz is President of Robert H. Herz LLC and a member of several corporate and advisory boards. In addition, he is an Executive-in-Residence at Columbia Business School. From 2002 to 2010, he was Chairman of the Financial Accounting Standards Board and was one of the original members of the International Accounting Standards Board. Mr. Herz also served on the Standing Advisory Group of the U.S. Public Company Accounting Oversight Board (PCAOB) from 2012 to 2020, and was a Board member of the Sustainability Accounting Standards Board Foundation (SASB) from 2014-2021. He was formerly a partner at PricewaterhouseCoopers. Mr. Herz has participated in several committees and task forces, including the Audit Committee Chair Advisory Council of the National Association of Corporate Directors, the G7 Impact Task Force, and the International Foundation for Valuing Impacts. He chaired the AICPA SEC Regulations Committee and the Transnational Auditors Committee of the International Federation of Accountants. He was also a member of the International Capital Markets Advisory Committee of the New York Stock Exchange and the American Accounting Association’s Financial Accounting Standards Committee. Additionally, Mr. Herz is a coauthor of the 2023 study issued by the Committee of Sponsoring Organizations of the Treadway Commission ( COSO ) that provides guidance to organizations implementing internal controls over sustainability information. | | Select experience •Internationally-renowned accounting, capital markets, sustainable business operations, and financial reporting expert •Seasoned public company board member with extensive governance knowledge Education and awards B.A. in Economics from University of Manchester, England, Accounting Hall of Fame inductee, Outstanding Achievement Award – Institute of Chartered Accountants England and Wales Other board experience •Director and Chair of Audit Committee, Morgan Stanley (NYSE: MS) (2012 to present) •Director and Chair of Audit Committee, Fannie Mae (OTCQB: FNMA) (2011 to present)

|

| Robert H. Herz, CPA, FCA Age: 69 | | | |

| Board member since 2014 Board Committees: •Audit, member •Nom/Gov, member | | | |

Mr. Herz contributes valuable perspective to our Board based on his background as a leader in the fields of auditing and financial reporting and his experience guiding large public and private enterprises.

Eugene S. Katz. Mr. Katz retired as a partner from PricewaterhouseCoopers in 2006, where he spent the majority of his career as an auditor, business adviser and risk management leader. From 2008 to 2014, he served as a member of our advisory board. He served on the governing board of PricewaterhouseCoopers from 1992 to 1997, and again from 2001 to 2005. Since 2007, Mr. Katz has served as a director of Asbury Automotive Group (NYSE: ABG), where he has chaired the audit committee since 2009 and served on the compensation committee since 2011. Mr. Katz holds a B.S. in Business Administration from Drexel University and is also a certified public accountant (inactive).

Mr. Katz brings extensive experience to our Board based on his background in accounting, auditing and risk management for a broad range of industries, with a particular focus on retail and technology companies.

David S. Mulcahy. Mr. Mulcahy has served as non-executive Chairman of our Board of Directors since June 2018. Since 2011, Mr. Mulcahy has served as a director and chairman of the audit committee of American Equity Investment Life Holding Company (NYSE: AEL). Mr. Mulcahy previously served as a director of AEL from 1996 to 2006, where he chaired the audit committee at the time of AEL's initial public offering in 2003. He also serves as a director of American Equity Investment Life Insurance Company of New York. Since 2008, he has served as the chairman of Monarch Materials Group, Inc., which manufactures and sells building products and was the successor to Monarch Holdings, Inc. Mr. Mulcahy also serves as president and chairman of the board of directors of MABSCO Capital, Inc. Mr. Mulcahy is an active investor in private companies and previously managed private equity capital for numerous banks and insurance companies. He is a certified public accountant (inactive) who was a senior tax partner with EY until 1994, where he specialized in mergers and acquisitions. Mr. Mulcahy holds a B.B.A. in Accounting and Finance from University of Iowa.

Mr. Mulcahy's extensive background in financial reporting and experience in accounting and business management contribute valuable perspective and experience to our Board. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | Skills | | |

| | |

| | | | | |

| Background Julie Iskow is President and Chief Executive Officer of Workiva, a role she assumed in 2023. She joined the Company in 2019 as EVP and Chief Operating Officer, and was promoted to President in 2022. She was previously Chief Technology Officer at Medidata Solutions, a SaaS technology and data platform for Life Sciences, where she was responsible for the development and execution of technology and product strategy, which contributed to a strategic sale in 2019. Before Medidata, Ms. Iskow was Chief Information Officer at consumer benefits SaaS platform WageWorks, which she helped take public in 2012. She spent the first 10 years of her career in engineering and technology leadership positions, focused on automation and robotics software. | | Select experience •Extensive experience leading and scaling SaaS companies to profitable growth •SaaS-specific business leadership, strategy, product development, data analytics and AI, sales, and operational expertise from her roles at Workiva and Medidata •Strong technical and cybersecurity expertise from her roles as Chief Technology Officer and CIO, and her engineering background Education and awards Master of Science – University of California, Davis; Bachelor of Science – University of California, Berkeley; InformationWeek Elite 100 2016 Other board experience •Five9 (NASDAQ: FIVN) (2023 to present) •Cvent (NASDAQ: CVT) (2022 to 2022) •Vocera Communications (NYSE: VCRA) (2019 to 2022) |

| Julie Iskow Age: 61 | | | |

| Board member since 2021 | | | |

10 WORKIVA INC.  2023 PROXY STATEMENT 15

2023 PROXY STATEMENT 15

Suku Radia. Mr. Radia retired as the Chief Executive Officer and a director of Bankers Trust Company in January 2018. Prior to joining Bankers Trust Company in 2008, he served as Chief Financial Officer of Meredith Corporation (NYSE: MDP) from 2000 until 2008 and practiced as a mergers and acquisitions partner with KPMG LLP for over 25 years. Mr. Radia also serves as a director of Nationwide Insurance Company. Mr. Radia holds a B.S. (with Distinction) in Accounting from Iowa State University and is a certified public accountant (inactive). | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Skills | | |

| | |

| | | | | |

| Background David S. Mulcahy has been President and owner of MABSCO Capital, which specializes in portfolio management, private equity, and financial consulting, for over two decades. He is also the Chair of Monarch Materials Group, Inc., a manufacturer and seller of building products to the residential construction industry. He has managed private equity capital for a number of banks and insurance companies. Mr. Mulcahy is a certified public accountant (CPA) and was a senior tax partner at Ernst & Young specializing in mergers and acquisitions until 1994. | | Select experience •Deep expertise in capital markets, M&A, accounting, and taxation developed at Ernst & Young and MABSCO Capital •Seasoned financial services board member with more than two decades spent as a director on American Equity Investment Life Holding Company’s board Education and awards BBA in Accounting and Finance (University of Iowa), Certified Public Accountant (inactive) Other board experience •Director, American Equity Investment Life Holding Company (NYSE: AEL) (1996 to 2006 and 2011 to present) ◦Non-Executive Chair and Chair of the Nominating and Corporate Governance Committee (2021 to present) ◦Chair of the Audit Committee (2011 to 2021) |

| David S. Mulcahy Age: 70 | | | |

| Board member since 2014: •Board Chair (2018-2023); •Lead Independent Director (2023 to present) Board Committees: •Audit, member •Compensation, member | |

Mr. Radia's experience in mergers and acquisitions and his background as an executive and director in diverse industries provide valuable contributions to our Board. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | Skills | | |

| | |

| | | | | |

| Background Suku Radia retired in 2017 after serving for almost a decade as Chief Executive Officer, President, and Director of Iowa-based community bank Bankers Trust. Prior to Bankers Trust, he served as Chief Financial Officer of media company Meredith Corporation (NYSE: MDP) for eight years. Mr. Radia spent the first 25 years of his career at KPMG, where he served as a mergers and acquisitions partner. He currently serves as Executive-in-Residence at the Ivy College of Business at Iowa State University. Mr. Radia has served on the boards of several charitable and educational organizations, including the United Way of Central Iowa, the Mercy Medical Center, and the Better Business Bureau of Iowa. | | Select experience •Substantial business leadership, capital markets, and M&A experience developed through decades in senior leadership and consulting roles •Accounting and financial expert, with direct Chief Financial Officer experience Education and awards Bachelor of Science in Accounting – Iowa State University, Certified Public Accountant (inactive), 2010 Iowa Business Hall of Fame inductee, United Way Tocqueville Honoree, and Iowa State Distinguished Alumni Award Other board experience •Nationwide Insurance Company (2014 to present) •National Chiropractic Mutual Insurance Co. (NCMIC) (2020 to present) |

| Suku Radia Age: 71 | | | |

| Board member since 2014 Board Committees: •Audit, chair •Compensation, member | |

Martin J. Vanderploeg, Ph.D.Mr. Vanderploeg has served as our President and Chief Executive Officer since June 2018, and as President and Chief Operating Officer since December 2014. Prior to that, Mr. Vanderploeg served as the Chief Operating Officer and a Managing Director of Workiva LLC from 2008 through December 2014. He has over 20 years of experience in mechanical engineering and advising early stage technology companies. Prior to founding Workiva in 2008, Mr. Vanderploeg was a founder of EAI and served as EAI's Executive Vice President from 1993 until EAI was acquired by Unigraphics Solutions in 2000. Mr. Vanderploeg served as Chief Technology Officer of EAI from 1989 to 1999. Following the acquisition of EAI, Mr. Vanderploeg continued to be an advisor to various technology start-up companies. Prior to EAI, Mr. Vanderploeg was a tenured professor of mechanical engineering at Iowa State University from 1985 to 1993 and was the founder and director of the Iowa State University Visualization Laboratory. Mr. Vanderploeg earned a B.S., M.S. and Ph.D. in mechanical engineering from Michigan State University.

As one of our founders, Mr. Vanderploeg contributes to our Board an in-depth understanding of our business as well as valuable perspective and extensive experience. Mr. Vanderploeg also brings to our Board significant operational experience and knowledge of our industry.

The Board recommends a vote "FOR" the election of Dr. Crow

and Mr. Katz as Class III directors.

11 WORKIVA INC.  2023 PROXY STATEMENT 16

2023 PROXY STATEMENT 16

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Skills | | |

| | |

| | | | | |

| Background Martin J. Vanderploeg has served as our non-executive chair since 2023, and is a co-founder of Workiva. He served as Chief Executive Officer from 2018 to 2023, President from 2014 to 2022, and Chief Operating Officer from 2008 to 2018. Prior to Workiva, Mr. Vanderploeg was founder and Chief Technology Officer of Engineering Animations Inc. (EAI), which he helped lead for a decade until its sale to Unigraphics Solutions, now part of Siemens USA. He began his career in academia as a tenured professor of mechanical engineering at Iowa State University, where he founded and directed the Simulation and Visualization lab. | | Select experience •Three decades of experience in scaling sustainable growth at software companies •SaaS-specific business leadership, strategy, product development, sales, and operational expertise from 15 years in Workiva’s senior leadership team •Extensive experience in enhancing value through building and maintaining a strong corporate culture Education and awards Doctorate in Mechanical Engineering, Master of Science, Bachelor of Science – Michigan State University; Software Leader of the Year 2022 – Chief Executive Officer Today Other board experience •N/A |

| Martin J. Vanderploeg, Ph.D. Age: 66 | | | |

| Board member since: 2014 Non-Executive Chair (2023 to present) | | | |

| | | | | | | | |

| The Board recommends a vote "FOR" the election of Dr. Crow and Ms. Iskow as Class III directors. | |

WORKIVA INC.  2023 PROXY STATEMENT 17

2023 PROXY STATEMENT 17

CORPORATE GOVERNANCE

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines that address, among other topics, the role and responsibilities of our directors, the structure and composition of our Board, and corporate governance policies and standards applicable to us in general. The Corporate Governance Guidelines are subject to periodic reviews and changes by our Nominating and Governance Committee and our Board. The full text of our Corporate Governance Guidelines is available on our website at http://investor.workiva.com/investors/corporate-governance.corporate-governance.

Code of Business Conduct and Ethics

Our Board has adopted "WLife","WLife," our code of business conduct and ethics, which applies to all of our employees, officers and directors, including our chief executive officer ("CEO"), our chief financial officer ("CFO") and our other executive and senior financial officers. The full text of WLife is available on our website at http://investor.workiva.com/investors/corporate-governance.corporate-governance. We will post any amendments to WLife or waivers of WLife for directors and executive officers on the same website.

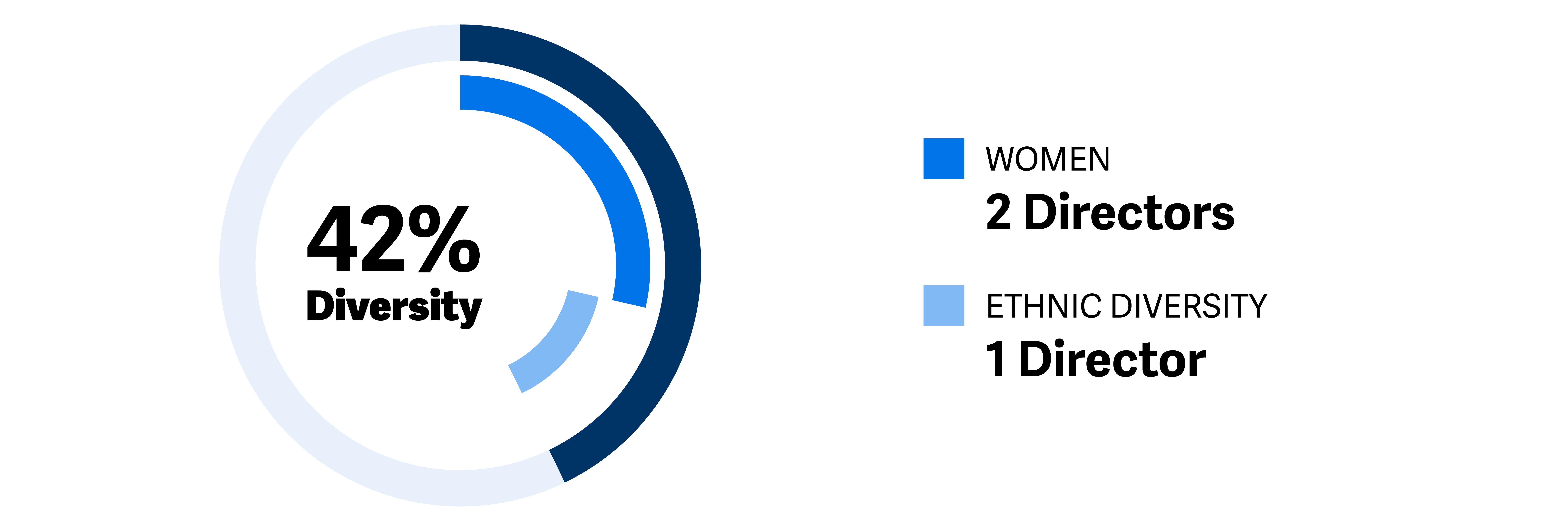

Board Profile & Diversity

Workiva and its Board believe diversity in the boardroom is critical to the success of the Company. Diverse backgrounds help our Board better oversee Workiva's management and operations, and assess risk and opportunities from a variety of perspectives.

The Board will continue to make diversity in gender, race/ethnicity, age, career experience and nationality a priority when considering director candidates.

The graph below sets forth the diversity representation data for Workiva's Board of Directors:

WORKIVA INC.  2023 PROXY STATEMENT 18

2023 PROXY STATEMENT 18

Environment, Social, and Governance ("ESG")

We believe that ESG reporting helps us to monitor and manage risks and opportunities related to environmental, social and governance impact. We have committed to continuously monitor risks through strong ESG reporting and disclosure practices and believe it will enable us to limit potentially costly disruptions, identify unsustainable areas within our organization, and strengthen our reputation of trust and transparency with investors and other stakeholders.

Workiva commits to ESG through authentic and purposeful action—supporting our people and customers, protecting the environment, and promoting ethical business practices. Our ESG strategy includes a robust governance structure with oversight by and accountability to the Nominating and Governance Committee of our Board of Directors. Additionally, our ESG Task Force, led by our CFO, engages internal and external stakeholders to ensure forward progress of our ESG goals.

We have committed to alignment with the United Nations Sustainable Development Goals (“UN SDGs”) and the Task Force on Climate-Related Financial Disclosures (“TCFD”). Workiva was the first SaaS company to join the United Nations’ CFO Coalition for the SDGs, where we work alongside other CFOs across the globe to guide companies toward aligning their sustainability commitments with credible corporate finance strategies, in order to create real world impacts. We received an AAA rating in the 2022 MSCI ESG Ratings assessment, which represents MSCI’s highest rating and signifies industry-leader status in managing significant ESG risks and opportunities.

Additional information around our ESG strategy is available on our website at http://workiva.com/about/our-sustainability. Our website, and information included on our website, is not incorporated by reference into this proxy statement.

Human Capital

Workiva is a great place to work and has trusted and equipped our employees to work from wherever and whenever is best for them. We have been on the Fortune 100 Best Companies to Work For® list since 2019 and attribute our success to our values-based culture. Our employee engagement rate is 93% and we have an employee attrition rate of 19% which is lower than the industry average. Workiva offers market-competitive compensation and benefits to attract and retain the best employees.

As of December 31, 2022, Workiva employed 2,447 full-time people worldwide. Our headcount as of December 31, 2022 increased 16.2% from 2,106 full-time employees as of December 31, 2021.

Innovation thrives when people feel welcomed, valued, respected, and heard. Diversity, equity and inclusion are core values at Workiva, and an important component of our social commitment in our ESG strategy. We strive to create a workplace where everyone is comfortable bringing their best, authentic self to work every day. As we scale, we know that continuing to develop our workforce is essential to our growth.

Workiva fosters a work environment that encourages fairness, teamwork, and respect among all employees. We value all backgrounds, beliefs and interests, and we recognize this diversity as an important source of our innovation and success. We believe that our culture of diversity, equity and inclusion increases employee engagement, empowerment,

WORKIVA INC.  2023 PROXY STATEMENT 19

2023 PROXY STATEMENT 19

and satisfaction. As of December 31, 2022, women represented 40% of our global workforce and 34% of our leadership (director level and above). As of December 31, 2022, 20% of our U.S. employees and 15% of our U.S. leadership (director and above) were from underrepresented racial/ethnic groups. Increasing diversity in our workforce and key operational leadership roles will remain an organizational priority. Current key initiatives include Business Employee Resource Groups (“BERG”), learning and development and talent acquisition. We maintain our BERG chapters globally across seven communities: Asian, Black, Disabilities, Hispanic & Latino, LGBTQ+, Veterans, and Women. Each BERG is sponsored and supported by senior leaders across the enterprise.

Additional information around our ESG strategy is available on our website at https://www.workiva.com/careers/diversity-equity-inclusion-belonging.

Director Independence

Our Board has undertaken a review of the independence of each director. Based on information provided by each director concerning their background, employment and affiliations, our Board has determined that none of Ms. Bonner, Dr. Crow, Mr. Herz, Mr. Katz, Mr. Mulcahy and Mr. Radia has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is "independent" as that term is defined under the applicable rules and regulations of the SEC and the listing requirements and rules of the NYSE. In making this determination, our Board considered the current and prior relationships that each non-employee director has with Workiva and all other facts and circumstances that our Board deemed relevant in determining their independence, including the beneficial ownership of our common stock by each non-employee director. In addition, our Board also considered that Mr. Radia served until January 2018 as the President, Chief Executive Officer and director of Bankers Trust Company, to which the landlord of our corporate headquarters has certain real estate mortgages payable. These loans were made in the ordinary course of business and preceded Mr. Radia being named to our Board. Our Board has concluded that these relationships are not material and, therefore, do not impair the independence of these directors.

Risk Oversight

OurRisk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, legal and compliance, and reputational. We have designed and implemented processes to manage risk in our operations. Management is responsible for managing the risks that Workiva faces every day, while our full Board, assisted by committees, exercises risk oversight at Workiva. Committees take the lead in discrete areas of risk oversight when appropriate. For example, the Audit Committee is primarily responsible for risk oversight relating to financial statements, thedisclosure controls and procedures and ESG disclosures. The Compensation Committee is primarily responsible for risk oversight relating to executive compensation philosophy and thepractices. The Nominating and Governance Committee is primarily responsible for risk oversight relating to corporate governance. In addition, bothgovernance, the fullindependence of the Board and Audit Committee exercise oversight with respect to risks related to cybersecurity.potential conflicts of interests and ESG policy. Our Board and its committees exercise their risk oversight function by regularly receiving and evaluating reports from management and by making inquiries of management concerning these reports, as appropriate. Furthermore, our Board and its committees receive reports from our auditors and other consultants, such as our compensation consultant, and may meet in executive sessions with these outside consultants.

Information security is of critical importance to our business. Our information security program is governed by enterprise policies derived from the National Institute of

WORKIVA INC.  2023 PROXY STATEMENT 20

2023 PROXY STATEMENT 20

Standards and Technology (“NIST”) and the International Organization for Standardization (“ISO”) industry standards. Our employees receive annual information security training and represent the first line of defense for Workiva and our customers. While our Information Security team ensures that adequate and ongoing discovery and management of risk is integrated with our enterprise risk management program, both the full Board and Audit Committee exercise oversight with respect to risks relating to information security. Our full Board and Audit Committee receive regular briefings from our Chief Information Security Officer on the state of our information security program, including with respect to current and developing trends of importance to the Company and the industry at large; mitigation strategies for the risks and threats facing Workiva; and the results of continuous monitoring and regular third-party testing of our information security posture. More information about our Security and Privacy policies can be found on our website at https://www.workiva.com/security.

Our Board believes that its current leadership structure supports the risk oversight function of the Board. In particular, our Board believes that our Lead Independent Director and our majority of independent directors provide a well-functioning and effective balance to the members of management on our Board, while allowing for open communication between management and our Board.

Communications with Directors

Interested parties may communicate with our Board or with an individual director by writing to our Board or to the particular director and mailing the correspondence to: Workiva Inc., 2900 University Boulevard, Ames, Iowa 50010, Attention: Corporate Secretary. The Corporate Secretary will promptly relay to the addressee all communications that hethe Corporate Secretary determines require prompt attention and will regularly provide our Board with a summary of all substantive communications.

Board Qualifications